THE Reserve Bank’s decision to cut interest rates by 0.25 percent on Tuesday 13 August, has been welcomed as a positive step for households across the nation, particularly the three million families managing mortgages.

The reduction equates to a saving of $74 per month on a $500,000 mortgage.

Member for Cowper Pat Conaghan, who is also the Shadow Minister for Financial Services, said the move would provide some welcome breathing space for many Australians.

“After a record 13 consecutive increases from May 2022 to January 2025, this third reprieve will leave many mortgage-laden households with a sense of relief,” Mr Conaghan said.

“It will be felt as a step in the right direction.”

Nevertheless, he warns that the broader cost-of-living crisis remains acute in regional Australia.

“In coastal regional electorates like mine on the Mid North Coast, we have seen house prices and rents skyrocket above the national average due to the surge in sea change migration from our major cities.

“Conversely, the average household income has stagnated, particularly acutely in the regions, meaning a larger percentage of weekly wages are required just to keep a roof overhead.”

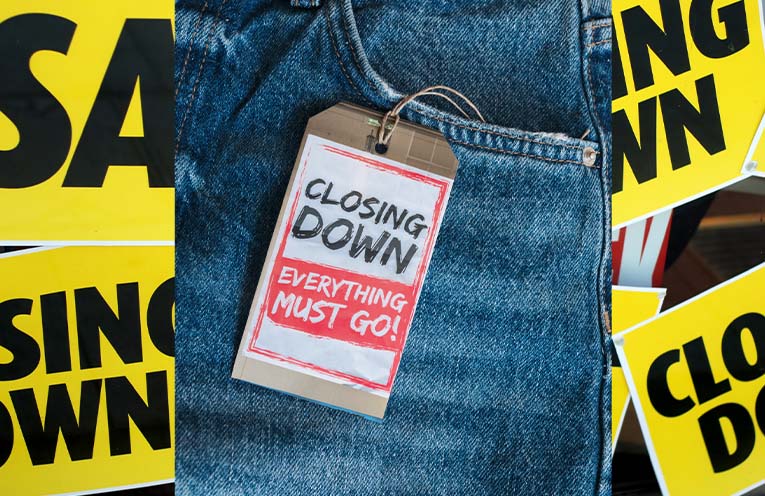

Mr Conaghan also pointed to pressures facing small businesses.

“Small businesses right across the country are being hit hard, illustrated by the fact that insolvencies are now at an all-time high.

“For regional Australia, small to medium businesses are the backbone of our local economies.

“When they suffer, our communities suffer.”

Australia’s major banks have confirmed they will pass on the full 0.25 percent cut to their customers, though with varying start dates.

Macquarie Bank’s new reduced rates came into effect on 15 August.

The Commonwealth Bank home loan variable rate and ANZ’s reduced rates are effective from Friday, 22 August.

Westpac’s reduced rates for variable home loans take effect on 26 August, as will NAB’s.

NAB’s Group Executive for Personal Banking Ana Marinkovic, said, “[the] RBA cash rate cut is a welcome change that should boost Australian optimism.”

While Mr Conaghan highlighted struggles felt in the regions, the Commonwealth Bank’s FY 2025 profits showed they exceeded $10 billion.

CEO Matt Comyn stated, “We have maintained our focus on supporting customers, particularly those still finding it tough dealing with cost-of-living pressures.

“Pleasingly, many households have seen a rise in disposable incomes due to the recent relief from reduced interest rates, lower inflation and tax cuts.”

Westpac CEO Anthony Miller, pointed to longer-term reforms.

“We are committed to supporting improvement in Australia’s productivity, recently making a submission to the Government’s upcoming Economic Reform Roundtable.

“Three key policy priorities for Westpac are increasing housing supply, investing in the regions and accelerating the energy transition”.

For households in regional areas, the rate cut offers immediate relief but does little to ease long-term challenges such as high rents, stagnant wages, energy costs, insurance premiums and declining access to services like local bank branches.

The big banks may be seeing green shoots of recovery, but on the Mid North Coast and in many regional towns, the struggle to balance household budgets remains very real.

By Sis HIGGINS